India’s solar journey has reached a decisive stage. With 100 GW of solar capacity already installed by March 2025, the next five years will define how the country strengthens its renewable backbone. A large share of this expansion will be driven by the Solar Inverter Market in India, which forms a core part of the broader Solar Market in India. Inverters remain the critical link that converts solar power into usable electricity for homes, businesses, and the national grid.

Looking ahead, understanding the solar inverter market in India goes beyond capacity numbers. It is about technology choices, evolving regulations, and the role of storage in shaping tomorrow’s power mix.

Solar Inverter Market Outlook in India (2025–2030)

India is set to add 200 GW of solar capacity between FY26 and FY30, with inverters at the center of this expansion. The distribution of this capacity is expected to follow three key segments:

- Utility-Scale Solar: ~120 GW, supported by large-scale tenders from SECI, NHPC, and SJVN.

- Commercial & Industrial (C&I) Rooftop: ~45 GW, driven by corporate sustainability goals and open access models.

- Residential Rooftop: ~35 GW, supported by schemes like the PM Surya Ghar Muft Bijli Yojana, which targets 1 crore households.

Market Value Projections

In terms of investment, the inverter market alone is projected at around ₹43,750 crore for FY26–30, distributed across segments:

- Utility-Scale: ₹15,000 crore

- C&I Rooftop: ₹11,250 crore

- Residential Rooftop: ₹17,500 crore

This mix highlights that while utility-scale remains the largest contributor in GW terms, the residential inverter market in India represents the highest value share because of higher per-watt pricing.

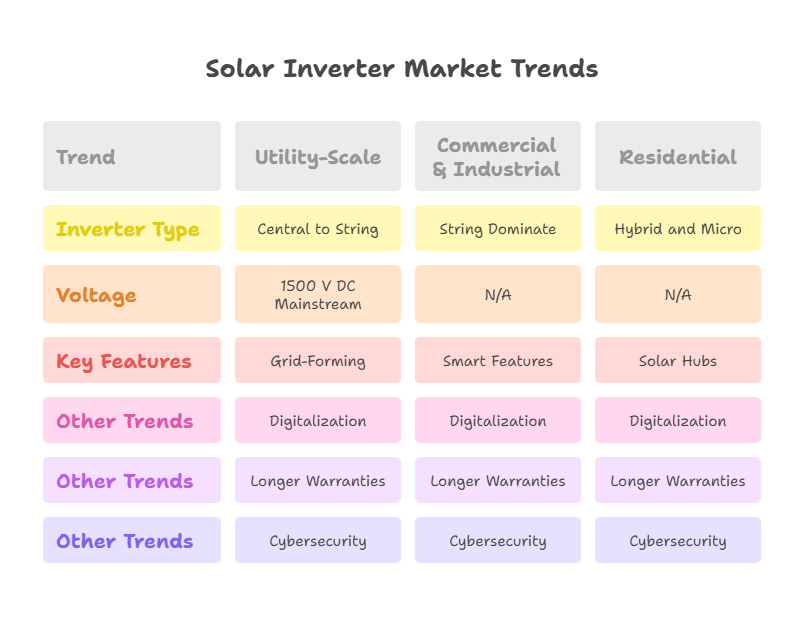

Technology and Segment Trends in the Solar Inverter Market

A mix of innovation, policy shifts, and evolving consumer needs is shaping the solar inverter market trends in India. Each segment – utility, C&I, and residential – shows distinct patterns.

Utility-Scale Solar Inverters

Large government-backed tenders are reshaping the role of inverters in utility-scale projects.

Key shifts include:

- Central to String Transition: High-power string inverters (350–420 kW) are gaining ground over central inverters due to better flexibility and ease of maintenance.

- 1500 V DC Mainstream: Widely adopted, with early discussions on 2000 V systems for future projects.

- Grid-Forming Inverters: Essential for grid stability, black-start capability, and balancing intermittency.

Commercial & Industrial Rooftop Inverters

The C&I segment is expected to add 45 GW by 2030. Corporates are increasingly turning to rooftop solar for both cost savings and sustainability commitments.

Trends to watch:

- String Inverters Dominate: Capacities of 20–125 kW suit most rooftop plant requirements.

- Smart Features: AFCI, multiple MPPTs, predictive O&M, and rapid shutdown systems are becoming standard.

- Load Shifting: As DISCOMs encourage alignment with solar peak hours, C&I consumers are adopting storage-ready inverters.

Residential Rooftop Inverters

With 35 GW projected by FY30, the residential inverter market is set for rapid adoption.

Core developments include:

- Hybrid Inverters Expanding: As net metering and banking face regulatory limits, hybrid systems with storage are becoming practical choices.

- Microinverters Rising: Offering module-level monitoring and ease of installation, these appeal to households in urban settings.

- Solar Hubs: Battery-ready solutions integrating PV, storage, and EV charging are being positioned as future-ready systems.

Cross-Segment Trends

Across all categories, some trends are universal:

- Digitalization: Cloud monitoring, AI-driven predictive maintenance, and remote diagnostics.

- Longer Warranties: Coverage now often extends 10–15 years, reflecting stronger reliability.

- Cybersecurity: With smart inverters tied to grid telemetry, MNRE and BIS compliance emphasize stronger data protection.

Policy and Regulatory Drivers

Government policy is central to the solar inverter market outlook in India. Between FY26 and FY30, several directives will shape project pipelines and technology adoption.

Ministry of New and Renewable Energy (MNRE)

- Enforcing BIS certifications aligned with global IEC standards.

- Encouraging domestic manufacturing, with discussions on an ALMM framework for inverters.

- Subsidy schemes such as PM Surya Ghar Muft Bijli Yojana directly support residential inverter demand.

Central Electricity Authority (CEA)

- Issued a directive in 2025 mandating two-hour co-located storage for all large-scale projects, covering at least 10 percent of installed capacity.

- This single policy ensures hybrid and grid-forming inverters become standard in utility projects.

Ministry of Power (MoP)

- Reinforced storage requirements across renewable tenders.

- Encourages load migration toward solar peak hours, indirectly boosting demand for smart inverters in the C&I segment.

SECI, NHPC, SJVN, and State Utilities

- Tender guidelines now specify storage-ready, hybrid-capable, and grid-supportive inverters.

- Projects require advanced features like black-start and inertia support, elevating the role of inverters to active grid enablers.

Financial Incentives for Storage

- The Government of India has approved Viability Gap Funding (VGF) of up to 40% of capital cost for storage, with disbursements running until 2030–31.

- This makes hybrid projects more financially viable, accelerating inverter innovation.

Future Outlook and Opportunities

The next five years will be transformative for the solar inverter market in India. By 2030, the market will not only be defined by its size (₹43,750 crore) but also by its role in shaping a resilient energy future.

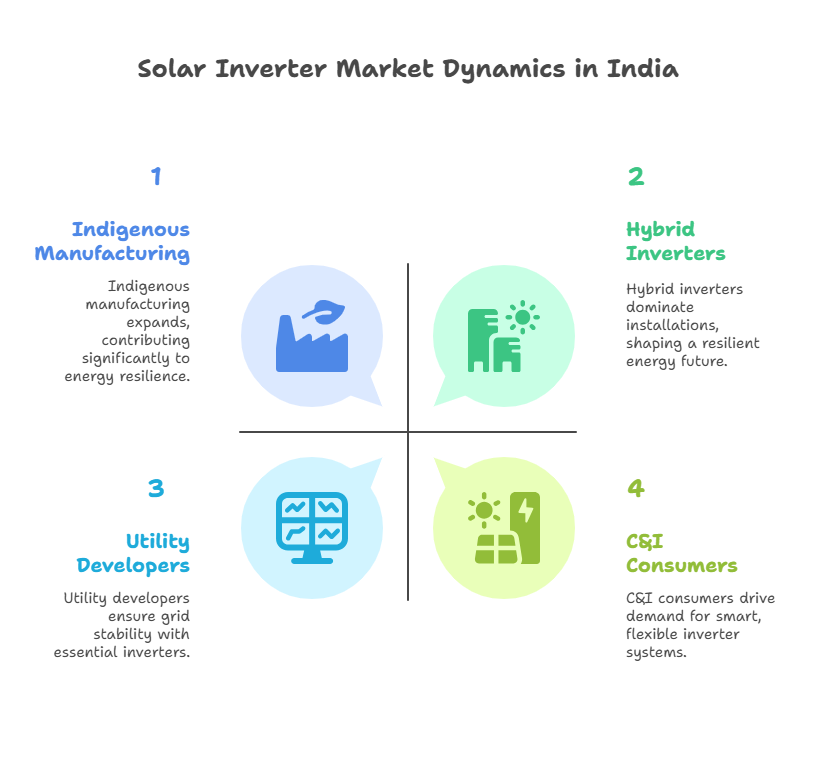

Indigenous Manufacturing

- Indian players like EnerCube, Enertech, and POM Power are developing inverter solutions for both utility and rooftop needs.

- With MNRE’s push for localization and a possible ALMM list for inverters, domestic production is expected to expand significantly.

- Collaborations between global OEMs and Indian manufacturers present opportunities for scale and advanced technology transfer.

Solar Plus Storage

- Hybrid inverters will dominate installations as storage becomes mandatory in new projects.

- Residential and C&I segments are expected to move toward battery-ready hubs, combining solar, storage, and EV charging in one ecosystem.

Sector-Specific Drivers

- Utility Developers: Policy-mandated hybrid readiness ensures grid-stabilizing inverters remain essential.

- C&I Consumers: Rising energy costs and sustainability targets will sustain demand for smart, flexible inverter systems.

- Households: Subsidies and future-ready features like EV integration will keep demand strong.

Why It Matters

- For businesses, advanced inverters mean stable operations and predictable energy costs.

- For households, hybrid-ready solutions ensure energy independence and reliability, even as grid policies evolve.

- For policymakers, scaling inverter deployment ensures grid stability and national energy security as India integrates more renewables.

The Road Ahead for Solar Inverters in India

India’s solar inverter market is entering a phase of rapid expansion and transformation. With 200 GW of new capacity expected by 2030, and policies mandating storage and hybridization, inverters will play a decisive role in powering the country’s clean energy transition. Utility-scale projects, C&I rooftops, and residential households will each follow unique growth paths, but the unifying trend is clear: a smarter, storage-ready, and digitally enabled inverter ecosystem that underpins India’s renewable future.

At Watplus, we are proud to be an official channel partner of GoodWe inverters, bringing reliable and future-ready solutions to India’s fast-growing solar market. Whether you are an EPC, distributor, or homeowner, our portfolio ensures you get the right inverter technology backed by strong technical support.

Explore our Products, or you can connect with us to find the right solution for your solar project.

FAQs

1. What is the projected size of the solar inverter market in India by 2030?

The market is projected at around ₹43,750 crore between FY26 and FY30, with utility, C&I, and residential segments contributing differently in volume and value.

2. Why are hybrid inverters gaining importance in India?

Hybrid inverters are essential as CEA mandates storage integration, and net metering restrictions push both residential and C&I users toward storage-ready systems.

3. Which government policies are driving the solar inverter market?

Key drivers include MNRE’s BIS compliance, CEA’s two-hour storage mandate, MoP’s peak load directives, and SECI/NHPC tenders requiring hybrid-capable inverters.

4. What opportunities exist for indigenous manufacturing?

Indian firms are expanding production capacity, and with MNRE encouraging localization and the possibility of an ALMM list for inverters, domestic manufacturing is poised for significant growth.